Financial Considerations

Most accredited courses in Australia are subject to fees, whether you choose to study at university or within the vocational education training sector. In addition to these course fees, there are other financial considerations you may need to take into account.

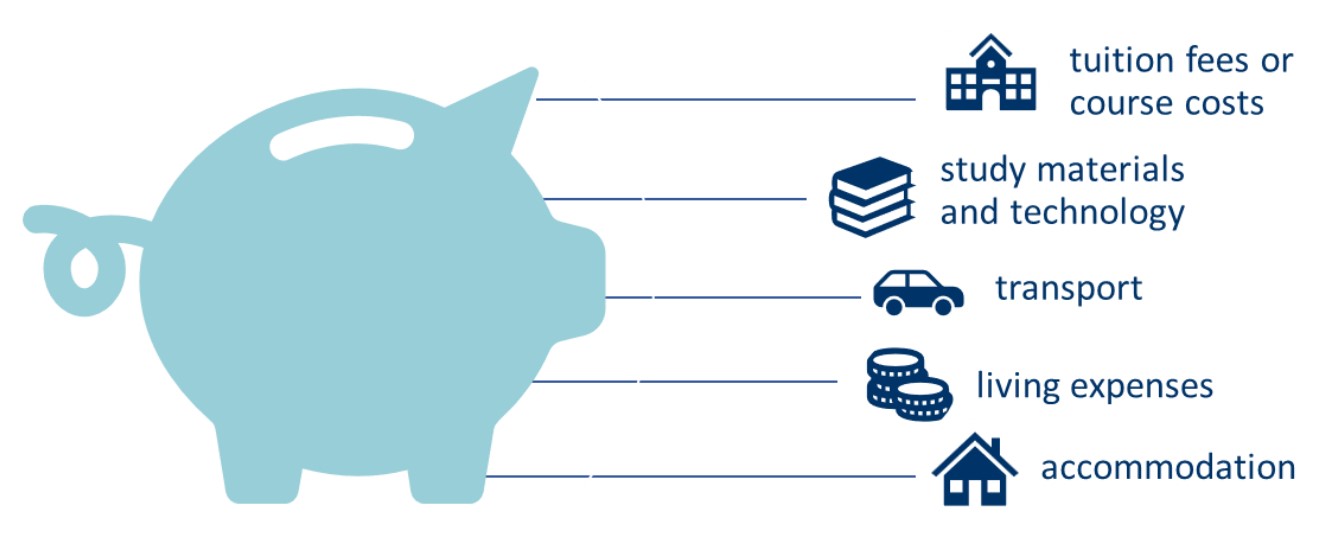

Expenses include:

- study materials such as textbooks and a computer

- specialist equipment, such as lab coats for science subjects, or art materials for visual art

- costs related to work-integrated learning or practical placements (e.g., safety equipment, vaccinations, tools etc).

- transport costs such as public transport, or petrol and parking

- everyday living expenses such as food, utilities, phone

- relocation costs and accommodation fees.

It is very important that you consider these additional costs in your budget.

More information about Accommodation can be found under Choosing Where to Study, and Student Accommodation and Services.

Your income

Most students cover the costs of their education through multiple income streams including:

- Study Assist

- Tuition fee loans (e.g., HECS-HELP, VET Student Loans)

- Scholarships and bursaries (either offered through the education provider or community)

- Paid work (such as a part-time or full-time job)

- Support from family (if available)

Make sure you have researched your options for study assistance and the tuition fee eligibility. When you look at different education providers look for opportunities to apply for scholarships or bursaries.

Scholarships may be offered for academic merit, sporting achievements, background (e.g. low-income background, Aboriginal and Torres Strait Islander, from a regional location, etc). If you meet the criteria then apply! You have nothing to lose by applying.

Also consider how you will balance your studies with work and how many hours you need to work to help with costs. If you have family support this is valuable too. It could be financial support, or in-kind support such as living at home, having a meal once a week, or internet access.

Tuition Fees and Course Costs

The type and level of fees you pay for your course depends on a range of factors, including the type of student you are (international or domestic), the course you are undertaking (e.g. bachelor, masters, diploma, certificate) and the type of provider you have enrolled with (e.g. government-funded university, private provider, VET provider).

VET fees

Contact your VET provider for more information about their fees.

Not all providers are approved to offer VET Student Loans. You can only access VET Student Loans at a registered training organisation that has been approved under the Higher Education Support Act 2003 to offer VET Student Loans to eligible students.

If you are enrolling at the Diploma level or above you may be able to access VET Student Loans (see below).

The Australian Government is offering fee-free TAFE ![]() for some courses to address skills shortages as well

for some courses to address skills shortages as well

University fees

Students planning on undertaking study at university must pay tuition fees. These fees are either subsidised by the Commonwealth Government (Commonwealth Supported Place) or are paid in full by the student.

There are three types of students at university:

- Commonwealth supported students who pay student contributions

- domestic students who pay full tuition fees up front

- international students who pay full tuition fees up front

To be eligible for a Commonwealth Supported Place at university you must be an Australian or New Zealand citizen or hold an Australian Permanent Resident Visa. Some Commonwealth supported students are eligible to defer payment of their tuition fees via the Higher Education Contribution Scheme (HECS-HELP) or to receive a discount for paying their student contribution upfront.

Domestic full fee paying students are required to pay the full fee that covers the costs of their tuition upfront.

Student Services and Amenities Fee

VET

Some VET providers may have an amenties fee or registration fee so check with your preferred provider.

University

Universities and other higher education providers can charge their students a fee to cover costs for provision of services and amenities such as sporting and recreational activities, employment and career advice, child care, financial advice and food services. This is called the Student Services and Amenities Fee (SSAF).

The government sets a maximum amount that higher education providers can charge you for SSAF. As of 2023 it is set at a maximum of $326 per student, which will be indexed each year. Students studying on a part-time basis cannot be charged more than 75% of the maximum amount that students studying on a full-time basis are charged. Under government legislation, universities and higher education providers cannot spend the money they collect from SSAF on activities such as support for political parties.

Any enrolled student can be charged SSAF, including if you are studying externally or part time, from a low SES or Indigenous background, undergraduate or postgraduate. However, some providers may adjust the amount that they charge students in these various categories. If you study part time you can’t be charged more than 75% of the maximum SSAF amount charged by the provider.

If the higher education provider charges you SSAF, you are obliged to pay it, regardless of whether you intend to use the services and amenities that the fee covers. The provider sets a date by which SSAF needs to be paid.

If you have difficulty paying SSAF upfront, you do have an option to defer all or part of the fee through an SA-HELP loan. If you opt to use SA-HELP, you only need to apply for it once for a specific course, although if you enrol in subsequent courses with the same or other providers, you would need to reapply for SA-HELP each time.